Is Antique Car Insurance in Florida a Good Deal in 2025?

Picture this: you're cruising down a sun-drenched Florida highway in your meticulously restored 1957 Chevy Bel Air. The wind's in your hair, the engine's humming, and heads are turning. But a nagging thought creeps into your mind – is my antique car adequately insured? In 2025, will that policy really protect my prized possession, or will I be left high and dry if something goes wrong?

Owning a classic car in Florida isn't always a smooth ride. Concerns about escalating repair costs, the availability of specialized parts, and the constant threat of hurricanes can keep even the most seasoned vintage vehicle enthusiast up at night. Standard auto insurance often falls short when it comes to properly valuing and protecting these unique pieces of automotive history, leaving owners feeling vulnerable.

So, is antique car insurance in Florida a good deal in 2025? Generally, yes, if you understand your needs and choose the right policy. Specialized antique car insurance is usually more affordable than standard auto insurance for these vehicles because it acknowledges their limited usage and collector status. These policies often offer benefits like agreed value coverage, which ensures you'll receive the full insured amount in the event of a total loss, and coverage for spare parts and restoration work.

In short, securing antique car insurance in Florida in 2025 will likely be a wise move for classic car owners. It offers tailored protection, potential cost savings, and peace of mind. Key considerations include agreed value coverage, usage restrictions, and the reputation of the insurance provider. This comprehensive guide will delve into the nuances of antique car insurance in the Sunshine State, helping you navigate the options and make an informed decision.

What Factors Influence Antique Car Insurance Rates in Florida?

I remember the first time I started looking into insurance for my '67 Mustang. I assumed it would be just like insuring my everyday car – a quick phone call and a monthly premium. Boy, was I wrong! The agent started asking me all sorts of questions about how often I drove it, where I stored it, and even what kind of security measures I had in place. It quickly became clear that insuring a classic car was a whole different ballgame.

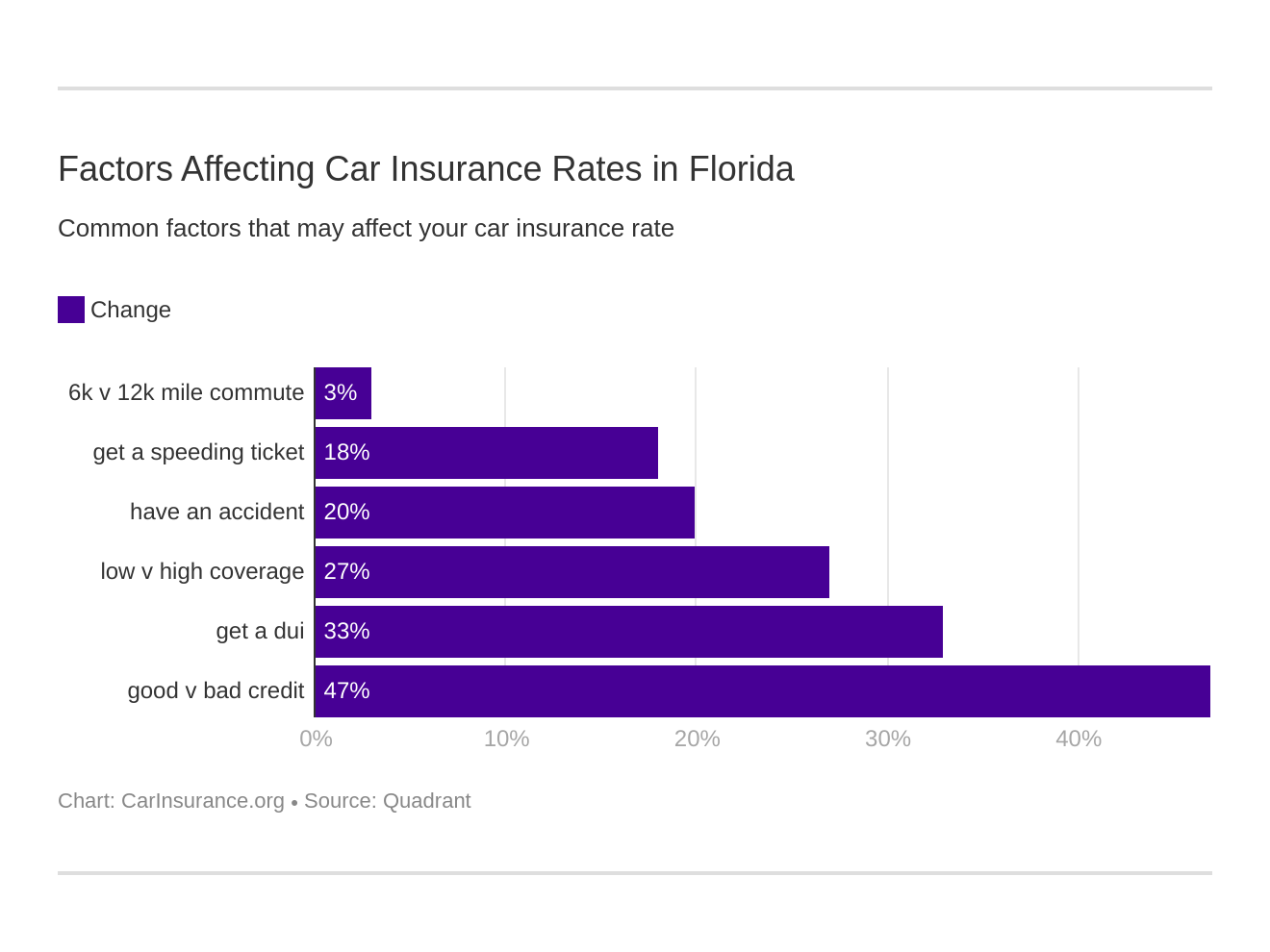

Several factors determine the cost of antique car insurance in Florida. Unlike standard auto insurance, which primarily considers your driving record and the car's make and model, antique car insurance places a greater emphasis on the vehicle's value, condition, and usage. Theagreed valueis a crucial element. This is the amount the insurance company agrees your car is worth, and it's what you'll receive if it's totaled. Make sure this value accurately reflects the car's market worth, considering its restoration, rarity, and overall condition.

Furthermore, usage restrictions play a significant role. Antique car insurance policies typically limit the number of miles you can drive annually and may restrict usage to car shows, club events, and occasional pleasure drives. The more you use the car, the higher the risk, and consequently, the higher the premium. Storage is another key factor. Garaging your antique car in a secure location reduces the risk of theft and damage, leading to lower insurance rates. Finally, security measures, such as alarms and tracking devices, can also contribute to lower premiums.

Understanding Agreed Value vs. Actual Cash Value

The difference between "agreed value" and "actual cash value" is arguably the most important concept to grasp when shopping for antique car insurance. Agreed value, as mentioned earlier, is the amount you and the insurance company agree your car is worth at the time the policy is written. If your car is totaled, you receive that agreed-upon amount, regardless of depreciation. This is particularly crucial for antique cars, as their value can fluctuate significantly based on market trends and restoration work.

On the other hand, actual cash value (ACV) takes depreciation into account. It's the replacement cost of the vehicle minus depreciation. For a standard car, this might be a reasonable approach, but for an antique car, it can be disastrous. Imagine spending years restoring a classic car, only to have it totaled and receive a fraction of its actual worth because the insurance company factors in depreciation. With agreed value, you're protected from this scenario.

Therefore, always insist on an agreed value policy for your antique car. Be prepared to provide documentation to support your valuation, such as appraisals, restoration receipts, and comparable sales data. A reputable antique car insurance provider will work with you to determine a fair and accurate agreed value that reflects the true worth of your prized possession.

The History and Evolution of Antique Car Insurance

The concept of specialized insurance for antique cars evolved as the classic car hobby grew in popularity. Initially, classic car owners had to rely on standard auto insurance policies, which often didn't adequately address the unique needs and values of these vehicles. As a result, a niche market emerged, with insurance companies developing tailored policies specifically designed for antique and collector cars.

The early policies were often basic, focusing primarily on liability coverage. However, as the market matured, insurers began to offer more comprehensive coverage, including agreed value, spare parts coverage, and protection during restoration. Today, antique car insurance has become a sophisticated product, with a wide range of options to meet the diverse needs of classic car owners. From basic liability to comprehensive coverage that protects against theft, damage, and even diminution in value, there's an antique car insurance policy to suit every vehicle and budget.

One common myth surrounding antique car insurance is that it's only for extremely rare or expensive vehicles. While these cars certainly benefit from specialized coverage, antique car insurance is also a smart choice for owners of more common classic cars. Even a well-maintained and restored vintage vehicle can be worth significantly more than its book value, making agreed value coverage essential.

Unveiling Hidden Savings in Antique Car Insurance

One of the best-kept secrets about antique car insurance is the potential for significant savings compared to standard auto insurance. This is primarily due to the limited usage restrictions that typically apply to these policies. Because antique cars are usually driven less frequently and under specific conditions, the risk of accidents and claims is significantly lower. This translates into lower premiums for the policyholder.

However, the savings don't stop there. Many antique car insurance providers offer discounts for various factors, such as membership in car clubs, completion of safe driving courses, and installation of security devices. Additionally, some insurers offer multi-vehicle discounts if you insure your antique car along with your other vehicles. Be sure to ask about all available discounts when shopping for antique car insurance.

Another often overlooked aspect of saving money on antique car insurance is the policy's deductible. A higher deductible will typically result in a lower premium. However, it's important to choose a deductible that you're comfortable paying out of pocket in the event of a claim. Carefully weigh the potential savings against the financial risk before making a decision.

Expert Recommendations for Choosing the Right Policy

When it comes to selecting the right antique car insurance policy, it's crucial to do your research and compare quotes from multiple providers. Don't simply choose the cheapest policy; instead, focus on finding the best value for your specific needs and vehicle. Look for an insurer that specializes in antique car insurance and has a proven track record of handling claims fairly and efficiently.

One key recommendation is to thoroughly review the policy's terms and conditions before signing up. Pay close attention to the coverage limits, exclusions, and any restrictions on usage. Make sure the agreed value accurately reflects your car's worth, and that you understand the claims process. If you have any questions or concerns, don't hesitate to ask the insurance provider for clarification.

Another valuable tip is to seek recommendations from other classic car owners. Talk to members of car clubs, attend car shows, and browse online forums to gather insights and advice from experienced enthusiasts. They can often provide valuable firsthand knowledge of different insurance providers and policies, helping you make a more informed decision. Furthermore, consider working with an insurance agent who specializes in antique car insurance. They can provide personalized guidance and help you navigate the complex world of classic car insurance.

Understanding Usage Restrictions and Their Impact on Premiums

Usage restrictions are a cornerstone of antique car insurance policies, playing a significant role in keeping premiums lower than standard auto insurance. These restrictions typically limit how often and under what circumstances you can drive your classic car. Common limitations include mileage restrictions, which specify the maximum number of miles you can drive annually, and usage restrictions, which limit driving to events like car shows, club meetings, and occasional pleasure drives.

The rationale behind these restrictions is simple: the less you drive the car, the lower the risk of accidents and claims. Insurance companies factor this reduced risk into the premium calculation, resulting in significant savings for policyholders. However, it's crucial to understand and adhere to these restrictions. Violating them could potentially void your coverage in the event of an accident.

When choosing an antique car insurance policy, carefully consider your driving habits and needs. If you plan to drive your classic car frequently, you may need to opt for a policy with higher mileage limits, which will likely result in a higher premium. Conversely, if you primarily use your car for car shows and occasional pleasure drives, you can likely get away with a policy that has stricter usage restrictions and lower premiums. It's a balancing act, but one that can save you a substantial amount of money.

Essential Tips for Securing Affordable Antique Car Insurance

Securing affordable antique car insurance requires a proactive approach and a willingness to shop around. Start by comparing quotes from multiple insurance providers specializing in classic cars. Don't settle for the first quote you receive; take the time to thoroughly research different options and negotiate for the best possible rate. Be sure to ask about available discounts, such as those for car club membership, safe driving courses, and security devices.

Another key tip is to maintain your car in excellent condition. A well-maintained car is less likely to be involved in an accident or require repairs, which can translate into lower insurance premiums. Keep your car properly garaged, regularly serviced, and free of any cosmetic or mechanical defects. Documentation of regular maintenance and repairs can also be helpful when negotiating with insurance providers.

Finally, consider increasing your policy's deductible. A higher deductible will typically result in a lower premium. However, it's important to choose a deductible that you're comfortable paying out of pocket in the event of a claim. Carefully weigh the potential savings against the financial risk before making a decision.

Understanding the Impact of Hurricane Season on Antique Car Insurance in Florida

Florida's hurricane season, which typically runs from June 1st to November 30th, presents a unique challenge for antique car owners. The threat of severe weather can significantly impact insurance rates and coverage options. Insurance companies are well aware of the risks associated with hurricanes, and they factor this into their pricing models. As a result, antique car insurance premiums in Florida may be higher than in other states with less severe weather risks.

Furthermore, some insurance policies may have specific exclusions related to hurricane damage. For example, a policy may not cover damage caused by flooding or storm surge. It's crucial to carefully review your policy's terms and conditions to understand what is and isn't covered in the event of a hurricane. If your car is stored in an area prone to flooding or storm surge, you may need to consider additional flood insurance to protect your investment.

To mitigate the risks of hurricane damage, take proactive steps to protect your antique car. Store it in a secure garage or building that is elevated and away from flood zones. Consider investing in hurricane straps or tie-downs to secure the car in place. And be sure to have a plan in place to evacuate your car if a hurricane is approaching. Taking these precautions can not only protect your car from damage but also potentially lower your insurance premiums.

Fun Facts About Antique Cars and Insurance

Did you know that the term "antique car" typically refers to vehicles that are over 45 years old, while "classic cars" are generally between 20 and 45 years old? This distinction can impact insurance eligibility and coverage options. Another fun fact is that some antique car insurance policies offer coverage for spare parts, which can be invaluable for owners of rare or hard-to-find vehicles. Imagine being able to replace a damaged or missing part without having to scour the internet or attend swap meets!

Furthermore, the most expensive car ever sold at auction was a 1962 Ferrari 250 GTO, which fetched a staggering $48.4 million. Insuring a vehicle of that caliber would require a specialized policy with extremely high coverage limits. On a more practical note, the average annual mileage for an antique car is typically less than 2,500 miles, which is why usage restrictions are such a common feature of antique car insurance policies.

Finally, the first auto insurance policy was issued in 1897, just a few years after the invention of the automobile. It covered a single steam-powered car and provided $5,000 in liability coverage. Today, the antique car insurance market is a multi-billion dollar industry, reflecting the enduring popularity of classic and vintage vehicles.

How to Properly Store Your Antique Car to Minimize Insurance Costs

Proper storage is paramount to minimizing insurance costs for your antique car. The ideal storage location is a secure, climate-controlled garage or storage unit. This protects the car from the elements, such as rain, sun, and humidity, which can cause rust, paint damage, and interior deterioration. A climate-controlled environment also helps prevent condensation, which can lead to corrosion and mold growth.

If you don't have access to a garage or storage unit, consider using a car cover to protect your vehicle from the elements. Choose a breathable cover that allows moisture to escape, preventing the buildup of condensation. Avoid using plastic covers, as they can trap moisture and cause damage to the paint. Additionally, consider using a dehumidifier in the storage area to further reduce humidity levels.

Before storing your antique car for an extended period, take several precautions to prevent damage. Change the oil and filter to remove contaminants that can corrode engine components. Fill the gas tank to prevent condensation from forming inside the tank. Disconnect the battery to prevent it from draining. And place jack stands under the axles to relieve pressure on the tires. Taking these steps will help ensure that your car remains in excellent condition during storage and that your insurance premiums remain as low as possible.

What If You Modify Your Antique Car? How Does It Affect Insurance?

Modifying your antique car can have a significant impact on your insurance coverage and premiums. Insurance companies typically consider modifications as increasing the risk of accidents and claims. Therefore, it's crucial to inform your insurance provider of any modifications you make to your vehicle. Failure to do so could potentially void your coverage in the event of an accident.

The type of modifications you make will also influence your insurance rates. Performance enhancements, such as engine upgrades, suspension modifications, and brake upgrades, can significantly increase the risk of accidents and claims, resulting in higher premiums. Cosmetic modifications, such as custom paint jobs, aftermarket wheels, and interior upgrades, may also affect your insurance rates, particularly if they increase the car's overall value.

In some cases, your insurance provider may require an appraisal to reassess the value of your modified antique car. This is particularly important if the modifications have significantly increased the car's worth. Be prepared to provide documentation of the modifications, such as receipts and photographs, to support your valuation. If you're planning to modify your antique car, it's best to consult with your insurance provider beforehand to understand how the modifications will affect your coverage and premiums. This will help you avoid any surprises down the road.

Listicle: 5 Reasons Antique Car Insurance is a Smart Investment in Florida

Here's a quick listicle highlighting why investing in antique car insurance in Florida is a smart move:

- Agreed Value Coverage: Ensures you receive the full insured amount in the event of a total loss, protecting your investment.

- Tailored Protection: Provides coverage specifically designed for antique cars, including spare parts and restoration work.

- Potential Cost Savings: Often more affordable than standard auto insurance due to limited usage restrictions.

- Peace of Mind: Offers protection against theft, damage, and liability, allowing you to enjoy your classic car without worry.

- Expert Claims Handling: Specialized insurers understand the unique needs of antique car owners and provide fair and efficient claims handling.

Question and Answer

Here are some frequently asked questions about antique car insurance in Florida:

Q: What qualifies a car as an antique in Florida for insurance purposes?

A: While definitions can vary slightly, generally a car must be at least 25 years old to qualify for antique or classic car insurance. Some insurers may have stricter age requirements.

Q: Is it possible to use my antique car as a daily driver with antique car insurance?

A: Typically, no. Antique car insurance policies usually have usage restrictions that limit driving to car shows, club events, and occasional pleasure drives. Using your antique car as a daily driver could void your coverage.

Q: What happens if I don't disclose modifications to my antique car?

A: Failing to disclose modifications to your antique car could void your insurance coverage in the event of an accident or claim. It's crucial to inform your insurance provider of any modifications you make to your vehicle.

Q: How do I determine the agreed value for my antique car?

A: Work with a reputable antique car appraiser or insurance provider to determine a fair and accurate agreed value. Provide documentation to support your valuation, such as appraisals, restoration receipts, and comparable sales data.

Conclusion of Is Antique Car Insurance in Florida a Good Deal in 2025?

Navigating the world of antique car insurance in Florida for 2025 doesn't have to feel like a daunting task. By understanding the key factors that influence rates, the importance of agreed value coverage, and the potential for savings, you can make an informed decision that protects your prized possession. Whether you're cruising down the coast in a vintage convertible or meticulously restoring a classic in your garage, having the right insurance coverage will give you the peace of mind to fully enjoy your passion for antique cars. Remember to shop around, compare quotes, and consult with experts to find the policy that best fits your needs and budget. The sun's out, the road's calling, and with the right insurance, you're ready to answer!

Posting Komentar untuk "Is Antique Car Insurance in Florida a Good Deal in 2025?"